Why Smart Owners Still End Up Broke

If you are new to our weekly entrepreneur newsletter, welcome! Each week, we research the issues impacting small business owners and entrepreneurs most, then share insights, strategies, and expertise to help you solve challenges and achieve your personal and professional goals. We hope you enjoy the content!

In This Issue

- Why “Grow Now, Fix Later” Backfires

- Common Cash-Flow Traps (Debt Spirals, Unpaid Payroll, Owner Last)

- A Step-by-Step Rescue Plan Using Profit First

- The PRU Method for Cutting Costs Without Gutting Growth

Why Smart Owners Still End Up Broke

We see it every week: talented tradespeople and creative founders who sell an amazing product but struggle to make payroll—or pay themselves—because they were told to “sell, sell, sell” first and worry about money later. When cash dries up, they open another credit card or tap home equity. It buys time—until the day every lender says no and the stress spills into sleepless nights and tense family dinners.

If that sounds uncomfortably familiar, take heart: you can climb out, but not by doubling down on the same habits that dug the hole.

A Step-by-Step Rescue Plan Using Profit First

-

Hit the Brakes—Stop Digging

- Freeze New Debt: No more quick-fix credit cards or loans.

- Pause Aggressive Growth: Scaling an unprofitable model magnifies losses. Stabilize first.

-

Slash Non-Essential Expenses

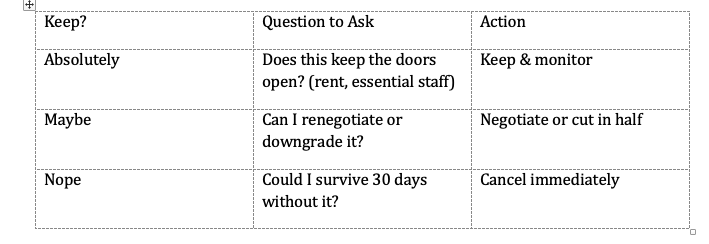

Use crisis triage on every cost with the PRU filter:

- P – Profit-boosting

- R – Renegotiate

- U – Unnecessary

-

Install Profit First—Even at 1 Percent

- Open Four Accounts: Profit, Owner’s Pay, Tax, Operating.

- Start Tiny: Transfer 1% of every deposit into Profit.

- Pay Yourself Next: Allocate a small Owner’s Pay percentage—break the “owner last” habit.

- Live on What’s Left: If Operating runs short, cut deeper or raise prices.

-

Repair Pricing & Margins Before You Scale

- Know Your True Costs: Material, labor, overhead, and debt service.

- Raise Prices or Bundle: Small increases often stick if value is clear.

- Kill Loss-Leaders: Stop selling products that drag margins below zero.

-

Keep a Simple Cash-Look-Ahead

Each Friday, list your expected cash in (upcoming sales/collections) and cash out (bills, payroll, loan payments) for the next four weeks. If a future week shows red, act now—collect faster, cut another cost, or defer non-critical spending.

The Bottom Line

1. Stop borrowing

2. Cut ruthlessly

3. Install Profit First

4. Fix margins

5. Look ahead weekly

Persistence with these basics turns panic into clarity—so your business starts paying you instead of your creditors.

This process can be really hard, but you don’t have to go it alone. We’re here to guide you. Schedule a free strategy session now!

See you next week!