The Growth Myth That Keeps Owners Broke

If you are new to our weekly entrepreneur newsletter, welcome! Each week, we research the issues impacting small business owners and entrepreneurs the most, and share insights, strategies, and expertise to help you solve challenges and achieve your personal and professional goals. We hope you enjoy the content!

In This Issue

- The Growth Myth That Keeps Owners Broke

- Why Paying Yourself Last Never Works

- A Simple Roadmap to Profit-First Thinking

- Your Dream Is Still Possible—Here’s How to Reclaim It

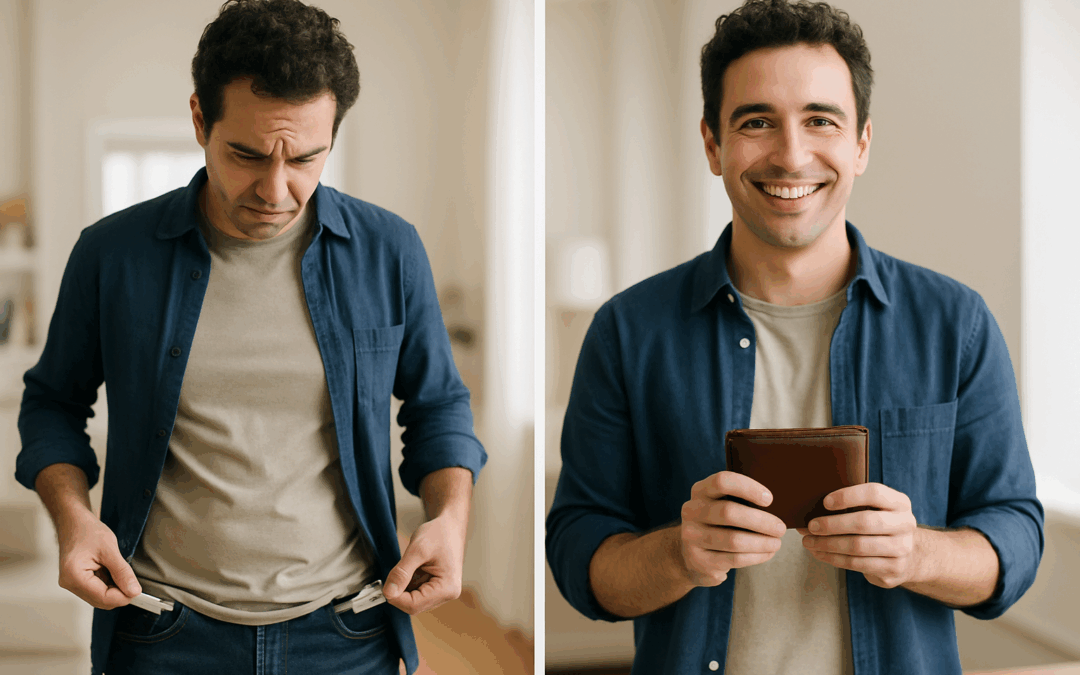

Are You Chasing Sales but Still Broke?

As an entrepreneur, how many times have you heard:

“Grow as fast as you can—cash and profit will follow.”

“Don’t expect to pay yourself for the first year or two.”

The result? Entrepreneurs hustle hard, double sales, and still can’t draw a paycheck. Expenses swell to match (or exceed) revenue, debt snowballs, and the owner earns less than minimum wage. This cycle repeats for years because focusing on top-line growth without prioritizing profit or owner pay means every dollar coming in is immediately spent. If that’s you, it’s time to flip the script.

1. Remember the Dream

You didn’t start your business to make less than a fast-food shift worker. You wanted freedom, impact, and fulfillment. When your company siphons every dollar—and your energy—those dreams get buried. Take a moment to recall your big dream: What life did you imagine for yourself and your family? What impact did you want to have? Let’s bring those goals back into focus.

2. Make Profit (and Owner Pay) the Top Priority

Key mindset shift: Top-line growth is secondary; owner profit is primary and non-negotiable. A business that loses $100 on every sale only bleeds faster when sales double. Profit must come first. Only when your business is making a profit should you chase more sales.

Action Steps to Break the Cycle

- Open separate bank accounts: Profit, Owner’s Pay, Tax, and Operating.

- Start small but start now: Move 1% of every deposit to Profit, 1% to Tax, and 3–5% to Owner’s Pay (enough to cover basic living expenses), and the rest to Operating. When Operating runs out—STOP SPENDING!

- Track every expense: Print the last 90 days of transactions and highlight anything you don’t absolutely need.

- Eliminate or reduce waste: Cancel, downgrade, or renegotiate highlighted costs to free up cash for profit and pay.

- Review weekly: Every Friday, compare revenue, expenses, and account balances to catch overspending early.

Next, grab a copy of Profit First and follow the process. Every business owner we’ve seen do the work experiences transformational change—night and day.

3. When to Focus on Top-Line Growth Again

Return to aggressive sales only after:

- Your Profit and Owner’s Pay accounts receive consistent allocations.

- Each sale contributes positively to net profit.

At that point, scaling adds cash instead of debt.

The Bottom Line

Your business should fund your life—not drain it. Follow these steps:

- Stop borrowing.

- Cut ruthlessly.

- Install Profit First.

- Fix pricing & margins.

- Keep a simple weekly cash-look-ahead.

Persistence with these basics turns panic into clarity—so your business starts paying you instead of your creditors. If you’d like support, accountability, or mentorship as you implement these changes, schedule a free strategy session now!

See you next week!