How to Get the Most from Your Bookkeeper

If you’re new to our weekly entrepreneur newsletter, welcome! Each week we research the issues impacting small business owners and entrepreneurs most, then share insights, strategies, and expertise to help you overcome challenges and achieve your goals. We hope you enjoy the content!

In This Issue

- Why owner access to accounting software is non-negotiable

- Red flags that your bookkeeper is not a good fit for you

- A checklist to hold any bookkeeper accountable

- Steps to boost your own financial visibility and confidence

The Problem: Great at Your Craft, Struggling With the Numbers

Many business owners excel at their trade but lack formal finance training. They trust an outside bookkeeper, only to discover months (or years) later that their data is inaccurate, late, or inaccessible. Worse, some bookkeepers refuse to give owners access to QuickBooks—holding files “hostage” until extra fees are paid.

Bottom line: You must retain full control of your books.

Non-Negotiable Rule #1: Own Your Accounting Software

- The owner (or trusted internal email) should be the primary admin on QuickBooks, Xero, or any platform.

- Grant your bookkeeper an accountant-level login—never primary admin rights.

- You are the legal owner of your financial data. Withholding access is unethical.

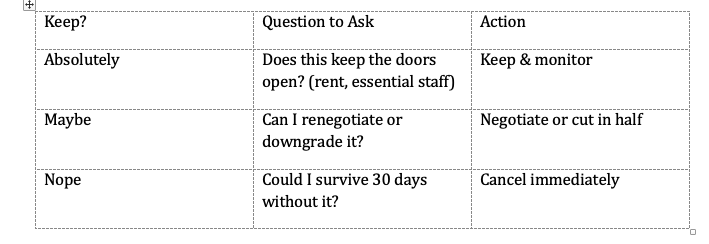

Red Flags That Your Bookkeeper Isn’t the Right Fit

- Refusing to give you ownership or access to your accounting software

- Updating books only at tax time, not monthly

- Surprise “release fees” for basic data

- Discouraging questions with “just trust me”

Key Qualifications to Look For

Here’s what separates a trusted bookkeeper from a liability:

1. Relevant Certifications & Experience

- Certifications (e.g., NACPB) or equivalent credentials

- Accounting/business degree and industry-specific experience

2. Attention to Detail & Accuracy

A good bookkeeper is meticulous—double-checking entries, reconciling monthly, and catching errors before they become problems. Ensure your books are updated at least monthly (weekly is even better).

3. Technological Proficiency

Look for mastery of cloud accounting tools (QuickBooks, Xero, etc.) and integrations—so you get real-time access to up-to-date financials, not outdated spreadsheets.

4. Effective Communication & Collaboration

You should feel comfortable asking questions and reviewing reports. A great bookkeeper explains data in plain English and tailors their support to your goals.

5. Forward-Thinking Mindset

Beyond reconciliations, top bookkeepers provide insights—spotting trends, flagging cash-flow bottlenecks, and highlighting high-margin products to guide your strategy.

Boost Your Own Visibility and Confidence

Visibility turns instinct into insight. Don’t just print financial statements—learn to read the story they tell:

- Track how every transaction flows through your books

- Cross-check for accuracy and spot anomalies

- Connect insights to daily decisions—act before small issues become crises

When you control visibility, you control profitability—and keep your dream business on track.

Schedule Your Free Strategy Session

See you next week!